What started as a rumour of a sharp increase in the prices of cooking oil quickly turned into a protest, as the kitchen crisis worsened.

As expected, most shoppers were incensed by the “greedy” retailers. No one blamed the market. Perhaps because the market is abstract and distant.

Few Kenyans care about what is “cooking” in the swathes of palm oil plantations in the two islands of Borneo and Sumatra in Asia. They only care for what is cooking in their kitchen.

Until now, they probably have not even heard of these names, leave alone the fact that the palm oil, which grows on some 7.8 million hectares in the two islands, is the reason their favourite dish is not as tasty as it used to be.

Palm oil is the main ingredient used to produce cooking oil. And most of Kenya’s palm oil comes from Indonesia where the two islands are found – though Malaysia, the second biggest market for Kenya’s palm oil – also has a political stake in the island of Borneo, which it shares with Indonesia and Brunei.

Palm oil, arguably the most efficient vegetable oil, is an ingredient in almost every processed product, from soaps to instant noodles, shampoos, bread, biscuits, lipstick, chocolate to washing powder.

It’s the country’s third-largest import spend after petroleum and medicine. This is why disturbances in the palm oil plantations in the two islands, and other places in Asia, reflect in Kenya through the high price of cooking oil and many other processed products.

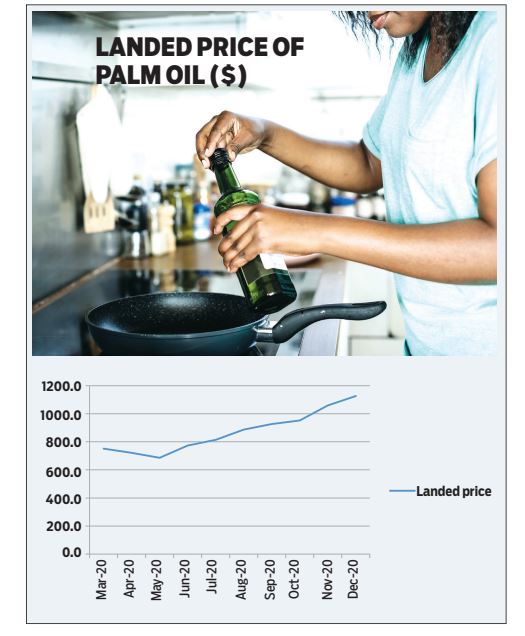

Beginning early last year, bad weather, low use of fertiliser and shortage of manpower triggered by social distance measures imposed by countries during the Covid-19 pandemic, depressed the production of palm oil in Asia.

As global prices of palm oil skyrocketed, with demand outstripping supply, the effects rippled across the Atlantic and Pacific Oceans, triggering a crisis in Kenyan kitchens, as cooking oil became unaffordable.

Latest data from the Kenya National Bureau of Statistics (Knbs) shows that a litre of salad cooking oil retailed at Sh227.6, an increase of 15 per cent from Sh197.53 in January last year.

However, a spot check by Financial Standard shows that in some supermarkets the price has gone beyond Sh300.

Besides Malaysia and Indonesia, Kenya also imports its palm oil from Cambodia, Thailand, China and India, taking up close to Sh60 billion worth of the country’s foreign exchange reserves annually.

More than 80 per cent of the vegetable oils consumed in Kenya is imported, with crude palm oil making virtually all of it at 93 per cent.

Other vegetable oils widely consumed in the country include soyabean oil, groundnut oil, sunflower seed oil and palm kernel oil.

There is also coconut oil, sesame seed oil and maize-germ oil. The average Kenyan consumes about six kilogrammes of vegetable oils annually in various forms.

Unlike processed palm oil, which is slapped with a higher import duty of 25 per cent, crude palm oil (CPO) attracts a preferential tariff of 10 per cent.

“Another reason for the major market share in CPO in Kenya is because Kenya imposes food fortification logo and certification policy towards vegetable oils and fats containing Vitamin A, and this has led to difficulty in the port clearing,” says Malaysian Palm Oil Council on its website.

By the end of September Kenya had imported 928,053 tonnes of animal and vegetable oils valued at Sh69.7 billion.

In the first nine months of 2019, the country imported 737,173.5 tonnes of animal and vegetable oils valued at Sh43.6 billion.

The country paid an average Sh73,521.7 for every tonne of animal and vegetable oils between July and September last year.

This was an increase of 20.6 per cent compared to the third quarter of 2019, when Kenyan importers paid an average of Sh58,382 for a tonne of animal and vegetable oils.

Following the outbreak of the novel coronavirus in the Chinese city of Wuhan, which would later spread like a wildfire to the rest of the world, Kenyans now appreciate how easy it is to import almost anything, including a high cost of living, with prices of critical imported products such as palm oil going through the roof.

Economists call it imported inflation – a general and sustained price increase due to an increase in the cost of imported products.

Kenya is welded strongly to the global supply chain, and any breakdown in the system is likely to reverberate in the lives of its citizens.

Abdulghani Mohamed Al-Wegih, the chairperson of the edible oil sub-sector at the Kenya Association of Manufacturers (KAM), a lobby for local manufacturers, said the edible oil that is sold in the local market is reflected in the worldwide market price.

All the local edible oil manufacturers – Bidco, Kapa, Pwani, Menangai and Golden Africa – all buy crude palm oil from Malaysia and Indonesia.

Seven months ago, a tonne of crude palm oil in the global market cost $600 (Sh65,400). Today it is selling at $1060 (Sh116,600) per metric tonne, with an additional $50 (Sh5,450) for shipping.

Abdulghani, who is also the General Manager Golden Africa, said the last time global prices of palm oil tanked to this level was in 1989.

“There was some crisis at the time,” he said, without going into specifics.

Edible oil manufacturers are bullish that the supply of crude oil will increase by mid-February, which will then push down the price of cooking oil in the local market.

Other than vegetable oils, another imported commodity whose prices have shot up due to depression in supply is wheat.

This has been reflected in the high prices of white bread, as the production of wheat flour becomes expensive.

On average, a 400-gramme white bread retailed at Sh51 in January 2021, up from Sh48 in the same month last year, official data shows. However, some brands of bread are going for as high as Sh55.

The leading source of Kenya’s wheat is Russia, from where the country imports 40 per cent of the cereal, followed by Argentina (20.5 per cent) and Ukraine (11.3 per cent) respectively.

Scholastica Odhiambo, an Economics lecturer at Maseno University, says Kenya imports most of its consumer goods, including agricultural ones.

This is unlike before when most imports were only restricted to durable goods such as machinery used by industries.

Ms Odhiambo attributes the shift to changes in lifestyle among households.

She says labour-saving devices, such as kitchen appliances, are some of the items whose importation has rallied as tastes and preference change.

There is also, she says, increased importation of ready-made clothes.

“This one you can observe through online markets and estates shopping malls,” says Odhiambo.

Aggressive production of crude palm oil to meet growing demand has left in its wake a major global warming crisis, as rainforests give way to the plantations.

The weakening of the shilling has only aggravated things. “Unstable foreign exchange and imports-related taxes and levies by the government have only aggravated the situation,” explains Odhiambo.

David Mukuha, the managing director at Naivas Supermarket, blames the weakening of the shilling for the increase in prices of most consumer products.

Most of the finished products, or their raw materials, are bought from outside the country using foreign currencies such as the US dollar.

However, a unit of the local currency is trading at around 110 against the dollar, having weakened from 103 before the country reported its first case of Covid-19 last March.

A weak shilling makes imported items expensive. “Immediately the shilling weakens, it affects almost everything,” says Mr Mukuha.

Another consumer product whose retail prices shot up in January compared to the same month in 2020 is electricity.

A unit of electricity retailed at Sh4,812 in January, up from Sh4,481 in the first month of last year.

A weak shilling saw the forex charge go up, as power producers passed on the additional cost to consumers.

Diesel-powered electricity provided by independent power producers is prone to fluctuations in the exchange rate, with a weaker shilling affecting the cost of diesel.

The price of diesel also shot up during this period, an increase that was reflected in the high cost of electricity.

The reversal of value-added tax (VAT) to the standard 16 per cent from the Covid-19 relief of 14 per cent has also contributed to the increase in the cost of electricity.

The cost of living – determined through inflation – the general increase in prices of goods and services in the economy – increased in January.

Overall, prices of consumer products increased by 5.69 per cent, year-on-year, compared to 5.62 per cent in December.

The sharp increase in prices of white bread and cooking oil, as well as diesel and electricity, contributed to the high cost of living last month.

“Prices of cooking oil (salad), white bread and cabbages went up by 10.4 per cent, 6.55 per cent and 3.39 per cent respectively,” said Knbs when it released the inflation rate for January.

However, prices of peas, mangoes and tomatoes declined during this period.

Besides wheat and palm oil, other foodstuffs that Kenya import include rice, onions, fish and raw sugar.

Kenya pays for all of these items using its foreign exchange reserves (forex), meaning a weak shilling translates into a higher cost of these items.

Moreover, a lot of manufacturing inputs such as petroleum, insecticides and fungicides, as well as fertilisers, are also imported and paid for with forex.

A packet of 500ml milk is also retailing at Sh55, up from Sh50, following a dry spell that has pushed up the cost of production.

Additionally, the cost of electricity has also been impacted by the weakening of the shilling, which has pushed up the foreign-exchange adjustment item.

Timothy Njagi, a research fellow at Tegemeo Institute, a think-tank, agreed that the increase in major food prices may also be due to the fact that January is generally a dry month, hence a drop in supply.

Life of destitution

In the case of milk, said Mr Njagi, the price hike is also due to increase in prices of animal feeds. This is partly due to the high VAT and increased cost of raw materials. Increase in animal feeds reflects in higher prices of milk almost immediately, he said.

“Even if there is a delay, it is not by more than a week,” said Njagi, adding that scarcity has also impacted prices.

Generally, the end of the Covid-19 goodies has opened a new floodgate of economic difficulties, with consumers grappling with increased prices of basic commodities.

The interplay of low incomes and high cost of production has consigned millions of Kenyans to a life of destitution, as they struggle with the increased cost of electricity, transport and foodstuffs such as bread, milk and cooking oil.

Credit: Source link