President Uhuru Kenyatta and Deputy President William Ruto are expected to share a Ksh.41.2 million slice of the budget as salaries and allowances over the next fiscal year.

According to remuneration data contained in the National Treasury budget books, basic salaries to the two constitutional offices are estimated at Ksh.24.7 million while the balance makes for allowances.

Allocations for the Deputy President Services office meanwhile total Ksh.1.8 billion out of a total Ksh.7.2 billion vote to the Presidency to include Ksh.176.9 million as development expenditure and Ksh.751 million as compensation to employees.

Former President Mwai Kibaki is meanwhile expected to receive a greater individual slice of the cake including a Ksh.22.6 million share as basic salary and Ksh.902,880 in allowances.

Further, the former President is further in line for a Ksh.34.4 million monthly pension.

Retired deputy presidents and other state officials including former Prime Minister Raila Odinga are set to receive a Ksh.50 million monthly pay out.

Total pensions to retired civil servants including members of parliament and the military are expected to round off to Ksh.119.2 million.

Online businesses to pay taxes for digital transactions

The Kenyan Government is planning to introduce a 1.15 percent digital service tax informed by the growing number of business transactions being carried out online.

When the framework is laid out, companies will be required to pay 1.15 percent of gross sales values as tax.

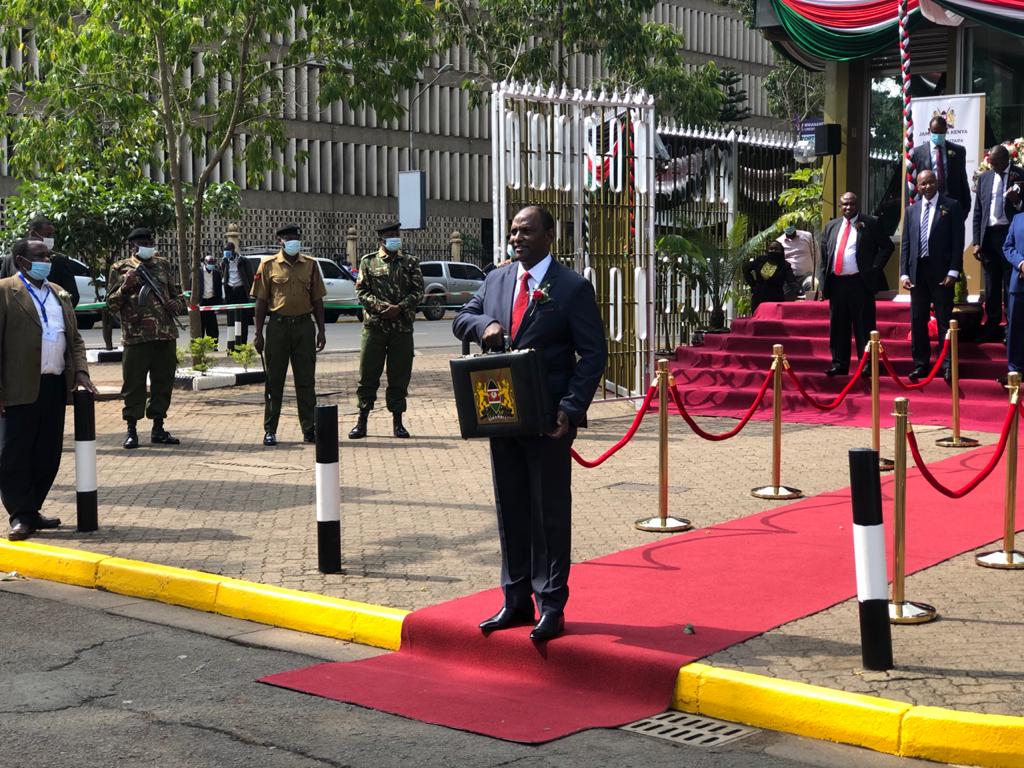

While presenting his maiden Budget Statement at the National Assembly on Thursday afternoon, Treasury CS Ukur Yatani noted that it is difficult to effectively tax the online income derived through digital platforms, hence the need to have a frame work in place.

The digital services tax deducted from the platforms and branches will be treated as an advance tax, available for set-off against the tax payable for the year of income.

The digital services tax which is computed at the rate of 1.5% of the gross transaction value will be payable when transferring payment to the service provider.

This follows the introduction of a provision for taxation of income from a digital market place through the Finance Act, 2019.

Earlier in June, the National Treasury published draft rules to bring the digital market place under the tax net, termed as the Value Added Tax (Digital Marketplace Supply) Regulations, 2020.

Subscriptions to popular streaming site Netflix will now be subject to VAT charges as the definition of the digital market place encompasses any businesses making direct transactions with buyers in Kenya irrespective of their country of residence.

“The regulations relate to any supply of a service made over a platform that enables the direct interaction between buyers and sellers of services through electronic means,” note the regulations.

Other businesses targeted in the VAT net include the sale of electronic event tickets, software programs, web hosting services and downloadable digital content.

Transport hailing platforms such as Uber, Little and Bolt will also be subject to VAT charges effectively raising consumer costs of using their services.

Consumers are expected to meet the new tax charges with suppliers submitting a record of all the supplies made in Kenya indicating the value of supplies and VAT deducted.

Failure to file the VAT returns within the prescribed period-the 20th day of the month following the end of the tax period will attract penalties including restrictions to the access of the local digital market place.

Online businesses have become a soft target for government to widen its tax base with the aim of lifting domestic tax revenues.

Credit: Source link