More than a year ago, Canada made recreational cannabis legal. So why are people still buying it on the black market?

When Canada legalised marijuana just over a year ago, it seemed like anyone who was anyone wanted to break into the market.

The media nicknamed the frenzy Canada’s “green rush”, as investors like Snoop Dogg and the former head of Toronto’s police force clamoured to get a slice of the multi-billion-dollar-pie.

But like the gold rush of the 1850s, the lustre would soon fade, leaving prospectors in the dust.

“It didn’t take a rocket scientist to recognise that these stocks were trading on fantasy and not on fundamentals,” says Jonathan Rubin, CEO of New Leaf Data Services.

With decades of experience in the energy commodities markets, Mr Rubin saw the legalisation of cannabis in states like Colorado and California in the US (and later Canada) as a “once in a lifetime” opportunity to get in on the ground floor of a brand-new commodity.

“I had this epiphany that this is going to be a commodity just like any other commodity,” he told the BBC.

What that meant was that like the price of wheat or pork, the wholesale price of cannabis was going to fluctuate with the market. So instead of investing in the cannabis itself, Mr Rubin started New Leaf to track the price of cannabis in states where it was legal. Investors and others in the industry pay for access to this data.

This business model has given Mr Rubin an interesting vantage point of how the market has unfolded.

In Canada, he says, the rollout has been disappointing.

“They haven’t had the growth in sales and earnings that they’ve envisioned,” he said. “I don’t want to say it’s a failure, but there’s definitely frustrations.”

Wholesale prices have dropped by about 17% since New Leaf started tracking data, which has kept profit margins tight for producers.

Sales have also slowed, according to Statistics Canada.

It’s led to a rollercoaster ride for the stock prices of publicly traded cannabis companies.

In May 2018, Canadian producer Canopy Growth made headlines when it became the first marijuana company to list on the New York Stock Exchange.

Six months later, the stock price about doubled when it hit a high of $52.03 (£39.77) a share.

Now, the stock price is back to where it was, and their competitors have suffered similarly drastic losses.

Growing pains

There were early signs of trouble.

When cannabis became legal on 17 October 2018, there wasn’t enough supply to meet the demand.

Long lines and backlogs of online orders plagued consumers. Producers weren’t sure what strains would be most popular where, and kinks in the distribution chain were still being ironed out.

“Trying to understand what strains we should grow, in what formats and what quantities – we did a great job but we didn’t nail everything,” says Canopy president Rade Kovacevic.

A patchwork of provincial laws have also made it harder to get products to consumers. While it’s easy to buy cannabis in some places, in others brick-and-mortar shops are few and far between.

This is especially true in Ontario, Canada’s most populous province. Red tape and a cap on the number of cannabis retail outlets have made rollout slow. Retail licenses were awarded by lottery, and the province held the number of licenses at 24, to serve a population of 14.5m.

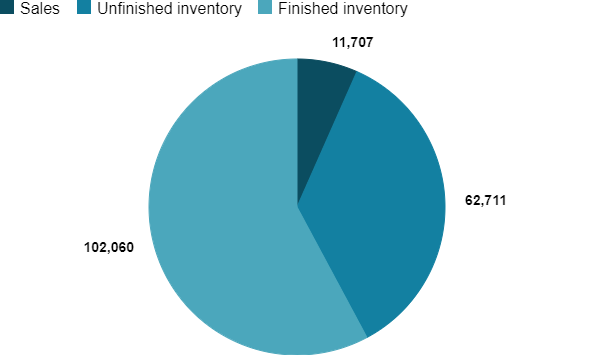

Cannabis supply and demand

In kilograms

In September, Canadians bought 11,707 kilograms (25,809 lbs) of dried cannabis flower in Canada. But producers had a total of about 165,000 kilograms of finished and unfinished products ready for sale, or more than enough to meet the demand for an entire year.

Mr Kovacevic blames the lack of retail in Ontario on a lot of his company’s woes.

“I think that lack of continuity of points of purchase across the country slowed the transition from the black market to the legal market,” he said. “It was a challenge.”

Black market still thriving

When the government announced its decision to legalise cannabis, one of its principal reasons was to reduce the black market.

But Statistics Canada estimates that about 75% of cannabis users still use illegal cannabis.

“There’s a very strong resistance to the legal stores in the sense that a) it’s more expensive and b) there aren’t enough of them. They’re not close to them, so they just deal with their local guy like they always have,” says Robin Ellis, co-founder of Toronto retailer The Friendly Stranger and a long-time activist for cannabis legalisation.

There were only five retail stores open in Toronto in 2019, and they were all concentrated in the downtown, which meant many people had to drive miles if they wanted to buy legal pot.

Legal cannabis is also far more expensive.

The retail price of legal cannabis has gone up, from C$9.82 ($7.49, £5.73) a gram in October 2018 to C$10.65 a gram in July, according to Statistics Canada.

Meanwhile, the illegal price has dropped from C$6.51 to C$5.93.

The case for cannabis

Perhaps one of the reasons why sales have been lacklustre for producers is that, contrary to some health experts’ fears, legalising marijuana didn’t turn everyone into a pothead.

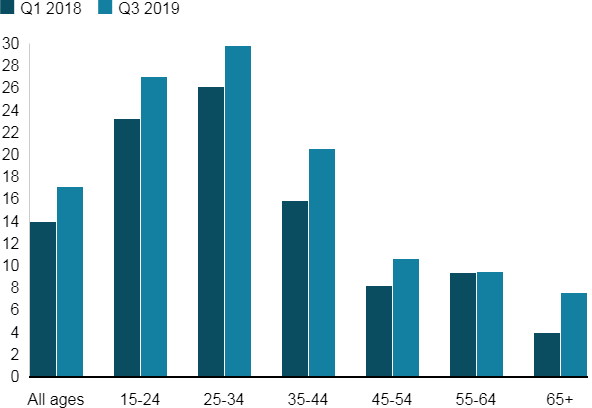

Over the past year, the percentage of Canadians who used cannabis grew from 14% to about 17%.

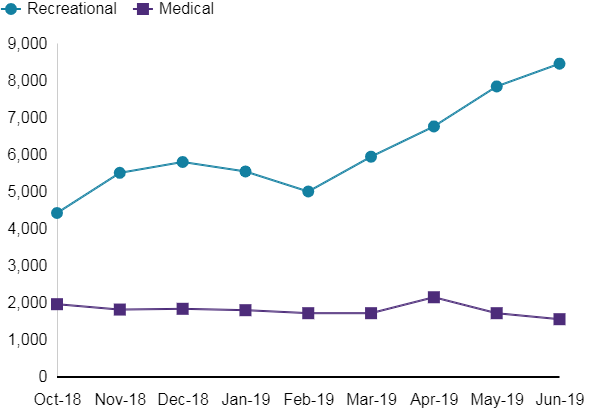

Cannabis sales

In kilograms

Use varies a lot by age, with people between 25-34 being the most likely to use cannabis, followed by those ages 15-24 (the legal age to use cannabis varies in Canada from 18-21). Older people are the least likely to have used cannabis, – but use has accelerated much faster for them than for other age groups, and seniors are the most likely to buy only legal weed, according to Statistics Canada.

This is in line with research in the US that shows that in states where cannabis has been legalised, usage among teenagers has actually decreased or stayed the same.

Cannabis use by age, self reported

Mr Ellis, a long-time cannabis activist, says it’s important to remember that despite the industry’s growing pains, legalisation has been largely a success.

“I don’t think Canadians fully understand the magnitude of this change. We didn’t just make something quickly available – it took 25 years of hard work to get legalisation ,” he says.

Legalising marijuana has also opened up a whole new industry for the Canadian economy.

Sales of legal dried bud blossomed from about 4,405 kilograms in October 2018 to 11,707 kilograms in September 2019.

The pot industry is now worth C$8.6bn, or about .3% of the country’s GDP in 2018.

Turning over a new leaf

Things are looking brighter for the New Year, people in the industry say.

In December, the Ontario government announced that after a slow and fitful start, the province will open itself up to more cannabis retail. It will do away with the lottery system, the cap on the number of private stores and cancel some pre-qualification requirements.

It’s welcome news to people who’ve been trying to get into the market.

“We’re really looking forward,” Mr Ellis says. His store, the Friendly Stranger, sells cannabis accessories, and he intends to open as many as 20 licensed retailers in the new year.

Producers will also be allowed to open up one storefront on site, similar to how some breweries can sell beer direct to consumers.

“If everything goes smoothly and they follow up, hopefully we’ll see more of an equilibrium in terms of supply-demand balance,” Mr Rubin says.

More kinds of products will also be coming to the market soon. The government is legalising alternative cannabis products, like edibles and vapes. Those products are expected to hit shelves around Christmas.

Up until now, Health Canada has only permitted cannabis oil, dried flowers, seeds and plants to be sold to consumers.

Mr Rubin expects these new products to help retail sales grow by 30-40%. The formats are expected to be a hit, especially amongst people who’ve never tried cannabis before.

“There’s going to be a lot of people out there who are going to want to try cannabis for the first time in a format that’s not smoking or vaping,” says Mr Ellis.

The new product lines are helping some producers attract investment. Constellation Brands, which makes Corona beer, owns a 38% stake in Canopy.

Mr Kovacevic, Canopy’s president, says they will rollout THC-laced beverages by early 2020. These products are designed to have a precisely known, low-level dose of THC, which would produce a buzz equivalent to the effect of one beer. They will not contain alcohol.

The company will also start making THC-laced chocolates.

“I think it’s a great opportunity,” he says. “If you look at products like vapes and edibles, those are products that are ubiquitous in the black market, and Canadians will now have the opportunity to go to a legal store.”

Credit: Source Link